Table of Content

If you receive 5% to help with your down payment, you have to repay 5% of your home’s fair market value at the time of repayment. Also, you have to repay every dollar received from the incentive after 25 years. There are rules to taking advantage of the CMHC’s down payment incentive. Firstly, you have to repay the government based on the fair market value of your home.

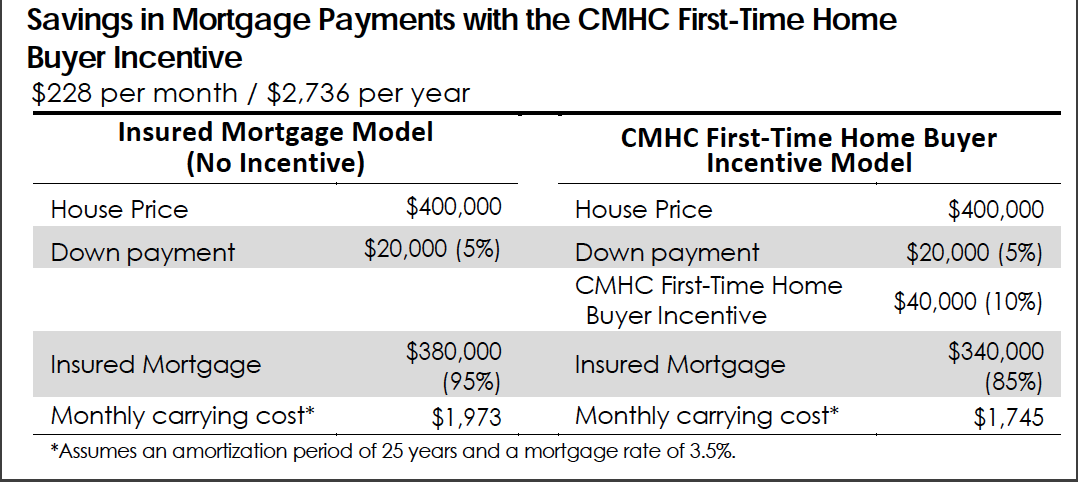

Instead of putting down a 5% down payment, they now put down as high as 15% from the added 10% loan received. The benefit here is that they will pay less in future mortgage payments, which makes a difference in the long run. CMHC First Time Home Buyer Incentive is a program that helps qualified first time home buyers purchase a home through an interest free loan and reduced mortgage payments. The program reduces the financial burden in purchasing a first home. To qualify for mortgages in the $400,000 to $500,000 range, a buyer’s household income would have to be close to six figures.

The First Time Home Buyer Incentive Program – What It Is

FHA 203k, or buy the house with a hard money loan, then refinance. Request a free home valuation and receive comparable sales prices of homes in your neighbourhood. The first-time homeowners incentive is an excellent opportunity for people looking to purchase homes in Toronto and Vancouver. In fact, about 23% of home purchases in Toronto are under $500,000. As mentioned earlier, you have to pay the government back after 25 years. Although, this payment is based on the fair market value of your home.

As of April, average prices in all three markets were above $1 million, and above $1.3 million in greater Toronto and Vancouver. Under this program, your monthly mortgage payments are reduced (because your downpayment is higher with CMHC’s contribution), thus making it more affordable to own your first home. The money from CMHC is provided interest-free, and because it’s an equity share and not a loan, there aren’t any traditional repayments required. The home buyer is still putting a down payment under 20% of the purchase price.

What do you need to qualify for CMHC?

This fair market value is determined as at the time of repayment. In this article, we will take a look at the benefits of this mortgage incentive for first-time homebuyers and how you can qualify to enjoy the FTHBI. The three-year $1.25-billion program had only approved $270 million worth of shared-equity mortgages as of December 31, 2021, with just $253 million in funds having been paid out to first-time buyers. As this is a shared-equity loan, the Government of Canada has a stake in the home equity. What this means for them is that they gain or lose on the investment with the home buyer. If there is any appreciation on the home price or home value, the government gains that added value when the home buyer sells the home and pays back the loan at a higher amount they borrowed.

Young adults are often burdened by student debt and have yet to accumulate the type of wealth that older Canadians have. The First Time Home Buyer Incentive Program aims to make housing more affordable for first-time Buyers. It’s essentially a shared equity program – where the Canada Mortgage and Housing Corporation contributes part of the downpayment in exchange for sharing in the appreciation when the home eventually sells.

Eligibility Requirements

This means that the government owns a shared investment with you as far as your home is concerned. This means that ups and downs in property value also affects the government. By putting down extra money toward your down payment, it can help to lower monthly mortgage payments, while potentially enabling home buyers buying a property below ~$500,000 to better afford a home. In exchange, the government gets an equal stake in the home’s equity, sharing in future gains or losses in value until the loan is repaid after 25 years or when the home is sold. If they contributed 5% of the purchase price when it was purchased, they get 5% of the purchase price when it sells.

Let’s say that the home you want to purchase is $300,000 and you’ve made a down payment of $40,000. Here’s how you would calculate your mortgage default insurance premium for these amounts. Simply put in the asking price and the amount you can afford for down payment. From this information, it’ll estimate your mortgage insurance premium.

The First-Time Home Buyer Incentive makes it easier for you to buy a home and lower your monthly mortgage payments. This means that the government shares in the upside and downside of the property value. It allows you to borrow 5 or 10% of the purchase price of a home. You pay back the same percentage of the value of your home when you sell it or within a 25-year window. The largest expense for most first-time homebuyers is their monthly mortgage payment.

Buying a home as a first-time buyer is incredibly overwhelming. There are so many questions about buying your first home – and that’s without even thinking of scraping together a deposit. Please send me more details about the incentive when they are available.

However, it definitely helps you with affordability, especially on mortgage payments. The funds must be fully repaid by the time the first insured mortgage reaches 25 years or the house is sold, whichever of the two occurs first. Should homeowners be able to save up enough to pay back the amount early before either one of the two scenarios occurs, no prepayment penalty will be charged. The mortgage + the FTHBI cannot be more than 4x total income (Mortgage-to-Income Ratio).If household income is maxed at $120,000, theoretically the max.

The primary benefit of this down payment incentive is that you do not have to pay as much on down payments out of pocket. That way, you can better afford the payments that come with your mortgage. Remember that more substantial down payments ultimately equal smaller monthly mortgage payments in Canada. Only insured mortgages qualify, which means down payments cannot be more than 20% of the purchase price. This program can get you property up to $722,000 in a CMA if you have the ideal qualifications (a maximum household income of $150,000 and a down payment of about 19.99%).

They are not part of the population this program seeks to benefit. When the home buyer decides to pay the loan back or sell their home in the future, they will pay back the same percentage they borrowed. This calculated percentage is from the appraised value or sale price at that current time. The First Time Home Buyer Incentive is a shared-equity mortgage with the Government of Canada, which means the home buyer and the government both own the mortgage together. The home buyer puts in a percentage of the mortgage and the Government of Canada puts in a percentage of the mortgage too. Serving our clients directly and growing our business is the only thing we do.

Close Guided Search The Guided Search helps you find long term services and supports in your area. A set of questions will help you identify services and supports that may meet your needs. Close Keyword Search The Keyword Search helps you find long term services and supports in your area. Many people are already wondering if the first-time homebuyer incentive Canada is free.

Toronto Real Estate News

A participant’s insured mortgage and the incentive amount cannot be greater than four times the participant’s qualified annual income. I'm hesitant to do the 2 rooms that aren't done yet because I don't want to waste money on them that could be spent on the down payment toward the house. I'm considering calling the county real estate dept. in the morning to see if they can help in anyway.

No comments:

Post a Comment