Table of Content

For years, she held her real estate license in Toronto, Ontario before giving it up to pursue writing within this realm and related niches. Lisa is very serious about smart money management and helping others do the same. If you’ve already repaid your FTHBI, you may be eligible for reimbursement. The Government of Canada is limiting the repayment share to 8% per annum. That means if you repaid more than 8% per annum, you may be eligible for reimbursement.

This fair market value is determined as at the time of repayment. In this article, we will take a look at the benefits of this mortgage incentive for first-time homebuyers and how you can qualify to enjoy the FTHBI. The three-year $1.25-billion program had only approved $270 million worth of shared-equity mortgages as of December 31, 2021, with just $253 million in funds having been paid out to first-time buyers. As this is a shared-equity loan, the Government of Canada has a stake in the home equity. What this means for them is that they gain or lose on the investment with the home buyer. If there is any appreciation on the home price or home value, the government gains that added value when the home buyer sells the home and pays back the loan at a higher amount they borrowed.

The first-time home buyer incentive

The First Time Home Buyer Incentive program could be very beneficial for certain individuals. It is meant to be used by home buyers in areas where real estate market prices are reasonable. This program is also meant for home buyers with under $120,000 of income total. This incentive program is in partnership with CMHC, a mortgage insurance provider, and the Government of Canada. CMHC, Canadian Mortgage Housing Corporation, is a crown corporation.

The government owns the company but they function on their own. Under the First-Time Home Buyer Incentive, Anita can apply to receive $40,000 in a shared equity mortgage (10% of the cost of a new home) from the Government of Canada. This lowers the amount she needs to borrow and reduces her monthly expenses. As a result, Taylor noted the program doesn’t really create any new market entrants.

Want to quickly know if you qualify?

If you have any questions regarding whether you qualify for the 2019 First-Time Home Buyer Incentive, or if this incentive is right for you, feel free to message us anytime. Of those participating in the program, the most common mortgage value is between $150,000 and $350,000, according to iPolitics. Just four successful applications were for a mortgage valued between $450,000 and $500,000. ÒFunds provided by the program will provide down payment and closing cost assistance. Resources that protect consumer rights, help with legal services and provide information on public s...

Close Guided Search The Guided Search helps you find long term services and supports in your area. A set of questions will help you identify services and supports that may meet your needs. Close Keyword Search The Keyword Search helps you find long term services and supports in your area. Many people are already wondering if the first-time homebuyer incentive Canada is free.

Search By Address

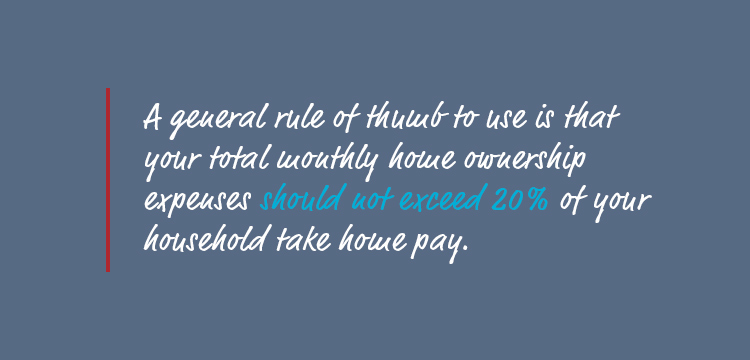

This monthly expense consists of both a partial repayment of the principal loan as well as interest accrued. The determination of how much homeowners need to pay each month is dictated by the amount of the mortgage loan received, the interest rate of the loan, and the amortization period. The CMHC incentive will help first-time homebuyers decrease their monthly mortgage payments by helping to increase their down payment. A larger down payment results in a reduction of the size of the loan needed to purchase a property. This effectively reduces the home buyers’ monthly mortgage expense. Qualified first time home buyers benefit from this incentive program because they receive a loan towards their initial down payment.

Loans Canada is not a mortgage broker and does not arrange mortgage loans or any other type of financial service. Without having to come up with a bigger down payment, buyers can obtain the funds to cut down on the overall loan amount to make it easier to secure a loan and reduce loan-to-value ratios. In turn, this will translate into smaller monthly payments, which can help free up more money to be spent elsewhere rather than having to dedicate a larger portion of income toward a mortgage. Depending on where you live, the price of homes could be extremely high and often out of reach, especially for first-time home buyers.

Shared equity loans mean the government will share in either the profit or loss when the home is sold. Home buyers must have at least a 5% down payment for an insured mortgage. They’ve limited the amount that can be borrowed to 4.5 times annual income, which effectively limits a first-time buyer’s purchasing power. Instead, your mortgage default insurance premium is added to your mortgage amount and paid off alongside your loan.

In exchange for lower monthly payments, buyers have to be willing to give up at least 5% of the value of their home to the federal government. This incentive aims to help first-time homebuyers without adding to their financial burdens. Participants must meet minimum insured mortgage down payment requirements. The Canadian government has rolled out a first-time home buyer inventive as part of our country’s National Housing Strategy as of September 2, 2019. This incentive allows you to reduce your monthly mortgage payments without increasing your down payment if you qualify for a mortgage with between five percent and ten percent incentives available. This program helps a certain population in Canada, but always take caution when taking the loan.

However, we expect many who use this program will have the minimum 5% down payment and are looking to get into the property market sooner with help from the CMHC. Only insured mortgages are eligible (mortgages with down payments worth less than 20% of the purchase price). By meeting this criterion, the Government will offer you either a five per cent loan for the purchase of a resale house, or five per cent or 10 per cent for the purchase of a new construction house. “All eligible participants would actually be able to borrow more using a traditional 5% down insured mortgage,” Mortgage Professionals Canada President and CEO Paul Taylor told CMT previously.

Bank informs me that I need to eliminate peeling lead paint in a different unfinished room. So I spend a weekend scraping it and skim coating it with drywall mud. I call the appraiser back to confirm when he could return to the house for updated pictures.

No comments:

Post a Comment